Education hub

9 May 2025

'Advertising doesn’t work for my clients!'

We have all heard it from our sales colleagues. Especially those in institutional sales.

‘My clients don’t respond to advertising.’ ‘They find it gimmicky.’ ‘They aren’t interested by pretty pictures from the colouring-in department.’ ‘They want facts and figures, that’s how they make their investment decisions. Not based on some ads.’

Advertising and brand marketing are often dismissed as irrelevant in the realm of professional investment management. The prevailing belief is that professional investors – in particular institutional investors but also wealth managers, consultants, and fiduciaries – make purely rational decisions based solely on performance data, fees, and mandates.

And you argue with your colleagues, ‘they are human beings like everyone else’, ‘they have families, they go to the pub, they have a laugh, they have ambitions, worries and dreams’. But you’re waved away.

Well then, as their clients are purely driven by science, facts and ratio, let’s look at the assumption in exactly that light. Let’s consult academics and scientists and see what they make of it.

There is mounting evidence from behavioural finance, cognitive psychology and empirical marketing studies that shows that even the most sophisticated investors are still human, and therefore subject to emotional and psychological influences. In fact, advertising and brand building are not merely relevant; they are essential strategic tools for asset managers seeking to differentiate, engage and influence professional investors.

Understanding the science behind decision biases

Where does the insight come from? The concepts of overconfidence, anchoring, framing and loss aversion which are central to this article are rooted in two intersecting fields of study: behavioural economics and cognitive psychology.

Behavioural economics emerged as a response to classical economic theories that assumed people make rational decisions. Instead, this field, pioneered by Daniel Kahneman, Amos Tversky and later Richard Thaler, demonstrated that individuals (including professionals) routinely deviate from rationality due to mental shortcuts (heuristics) and psychological biases. Among the core principles they have identified are the following:

- Loss aversion – people feel the pain of losses more acutely than the pleasure of equivalent gains.

- Framing effects – decisions can change based on how information is presented.

- Present bias and status quo bias – a preference for immediate rewards or existing conditions.

This is complemented bycognitive psychology. It studies how the brain processes information: how we perceive, remember and make judgements. It provides the framework for understanding why these biases exist. In particular, Kahneman’s Thinking, Fast and Slow popularised the dual-system theory of decision-making:

- System 1: Fast, intuitive, emotional thinking

- System 2: Slow, rational, deliberate thinking

Most decisions, even those made by highly trained professionals, are heavily influenced by System 1 processes, especially under pressure or uncertainty, as is often the case in investment management.

Together, these disciplines explain why professional investors, despite education and experience, remain susceptible to the same behavioural patterns observed across all human decision-making.

Professional investors are not Immune to human behaviour

And thank God for that. They’d be deeply unhappy and so would everyone else who had to deal with them. So let’s debunk that persistent myth in financial services that professional investors operate in a purely rational, data-driven vacuum. While it is true that their processes are rigorous and standards high, behavioural finance demonstrates that even professional decision-making is prone to cognitive bias, heuristics and emotional resonance.

Key behavioural biases that affect professional investors include:

- Overconfidence

bias: Professionals may overestimate their ability to evaluate

managers purely on metrics. This manifests when decision-makers place

excessive trust in their own judgement, assuming they can detect the

best-performing managers using data alone. As a result, they may

underestimate the role of subjective perception, overlook long-term brand

consistency or dismiss softer, qualitative signals. This is a very human reaction

and not limited to professional investors – we all have experienced this

in an area where we feel competent only to find out that not every

decision has been as wise as we thought.

Overconfidence can also lead to decision inertia, where an investor sticks with their initial judgment despite new or contradicting information. This is a reason why advertising and communication in general is as important in a downturn in the market or a underperformance of the investment. The investor doesn’t want to be wrong and provided that you communicate effectively and reassure your clients, retention rates will be significantly higher.

- Anchoring

bias: Initial impressions, such as brand visibility, meeting tone or

early exposure to marketing materials, can disproportionately influence

final decisions. When a manager is first encountered in a high-impact

setting – through a keynote, an award-winning ad or a compelling first

meeting – this initial anchor can shape all subsequent evaluations. Even

if competing managers present superior performance data, the anchoring

effect can cause investors to unconsciously benchmark everyone else

against the first brand encountered.

A pretty package with a bow tied around it sells better than just the content. Nobody is immune to this, not even a professional investor.

- Framing effect: How information is presented – via narrative, visualisation, tone or context – can alter perception of the same data. For example, a five-year annualised return of 6.8% may seem attractive when framed against inflation or a benchmark, but less so when compared to competitors’ 7%. Managers who frame their message using confident, story-driven or emotionally resonant language are more likely to shape favourable perceptions, even if the raw figures are identical. Professional investors, despite training, are still susceptible to the psychological influence of language, tone and visual framing.

- Loss aversion: A tendency to weigh potential losses more heavily than equivalent gains may lead to defensive decision-making, favouring more familiar or ‘safer’ brands. Professional investors often face reputational risk – not just portfolio risk – when making allocations. Choosing a lesser-known or unbranded manager may carry a perceived risk of negative scrutiny, whereas selecting a well-known house provides ‘cover’. This defensive posture, driven by loss aversion, favours incumbents and brands that have cultivated familiarity and trust over time, even when performance comparisons are neutral or unfavourable.

The insight here is not that professional investors are irrational, but that they are human. Advertising that builds familiarity, credibility and trust can subtly influence their perception in competitive environments where many offerings are technically comparable.

The role of brand in high-stakes decisions

In the complex landscape of professional investing, brand acts as a heuristic device, a mental shortcut for trust. With hundreds of asset managers offering similar strategies, performance metrics alone are not always decisive.

Brand contributes in several crucial ways:

- Trust signal: A strong, consistent brand suggests stability, competence and alignment with client values. For fiduciaries and advisers responsible for the long-term stewardship of capital, brand familiarity provides emotional and reputational assurance. A recognised brand represents a track record of reliability, regulatory compliance and market presence, reducing anxiety about potential risks and reinforcing perceptions of credibility.

- Differentiation: Visual identity, tone of voice and thematic consistency make a manager more memorable. In a sea of investment proposals and performance summaries, a brand that communicates with clarity and consistency stands out. Whether through a distinct visual design system, a well-articulated philosophy or a consistent narrative voice, differentiation helps decision-makers recall the brand in later stages of evaluation. This memorability becomes especially important when multiple stakeholders are involved in a collective decision process.

- Defensibility: When decisions must be justified to investment committees, boards or external consultants, choosing a well-regarded brand reduces perceived career and reputational risk. Professional investors operate in environments where accountability is paramount. Opting for a recognised brand provides a form of professional cover, mitigating scrutiny and signalling that the selection is aligned with industry standards and expectations. In this way, brand serves not only as a selection filter but also as a post-decision rationalisation tool.

This aligns with a key finding in the Myners Report, which noted that pension trustees often rely on brand familiarity and perceived reputation as proxies for quality, particularly in situations of limited technical understanding.

People may argue that this relates predominantly to the trustees whose knowledge about investments and the markets may be limited. The same is true for professional investors.

After all, there is a reason why an adage like ‘Nobody ever got fired for buying IBM’ could evolve and be true for decades now to describe typical buying decisions of professional buyers across all industries.

Brand Impact Pyramid: understanding how brand influences professional investor decisions

Your professional investor will look at how you differentiate yourself from the competition. But they will only do so once you’ve passed two much more important hurdles: do they know you and do they trust you.

The Brand Impact Pyramid illustrates the layered influence that brand exerts on the decision-making process of professional investors. It is inspired by principles from behavioural economics and B2B marketing strategy.

Base Layer – Familiarity

- This is the foundational level of brand influence.

- A familiar brand is simply one that comes to mind easily when investors are considering asset managers.

- Familiarity is built through repeated exposure – advertising, event presence, media mentions and consistent messaging.

- It reduces perceived risk by eliminating the unknown, which is especially important in high-stakes decisions involving fiduciary responsibility.

Middle Layer – Trust

- Once a brand is familiar, it must earn trust through perceived credibility, competence and alignment with values.

- Trust is often reinforced by thought leadership, consistent performance, ESG credentials and reputational strength.

- Investors are more likely to engage with managers they believe are stable, reliable and intellectually honest.

Top Layer – Differentiation

- At the top of the pyramid is the ability to stand out in a crowded and commoditised market.

- Differentiation comes from a distinct value proposition, memorable visual identity, unique tone of voice and thematic clarity.

- This is the stage where brand preference translates into shortlist inclusion and ultimately investment selection.

Advertising enhances mental availability

The concept of mental availability, popularised by Byron Sharp (How Brands Grow), refers to the likelihood of a brand coming to mind in a relevant decision-making moment. Advertising plays a key role in building this availability over time.

Professional investors, like all humans, rely on memory shortcuts when sifting through information. Advertising reinforces:

- Top-of-mind recall during shortlist creation

- Emotional resonance that complements rational due diligence

- Perceived scale and permanence, reducing fear of manager risk

In long B2B sales cycles, advertising also performs the essential function of priming: subtly shaping how future interactions are interpreted. A well-crafted campaign can lay the groundwork for trust and receptivity before a relationship manager even makes contact.

Emotional engagement in professional contexts

Professional services marketing often overemphasises rational appeals. Yet research from the Institute of Practitioners in Advertising (IPA) shows that emotional campaigns are more effective at building long-term brand strength than rational-only messaging. In fact:

- Emotionally driven B2B campaigns outperform rational ones by a factor of 2:1 in effectiveness.

- Emotionally resonant messages are more likely to be remembered, repeated and acted upon.

Professional investors are still influenced by storytelling, values and vision. Campaigns that communicate a manager’s ethos, long-term commitment or responsible investing philosophy can forge deep connections, particularly in sectors like ESG and impact investing.

We see empirical evidence from the work by Aureum and Sonar (Fundamental Group’s marketing consultancy and creative solutions businesses) whereby repackaging perfectly good content in an engaging way that tells a story and allows the investor to engage and interact delivers considerably better results against all KPIs.

Empirical evidence: brand drives preference

Multiple studies support the case for advertising in professional asset management:

- McKinsey & Co. has documented how brand familiarity significantly impacts manager selection, especially when performance differences are marginal.

- LinkedIn/Ehrenberg-Bass Institute: B2B buyers (including professional investors) are more likely to choose familiar brands, even if others are technically superior.

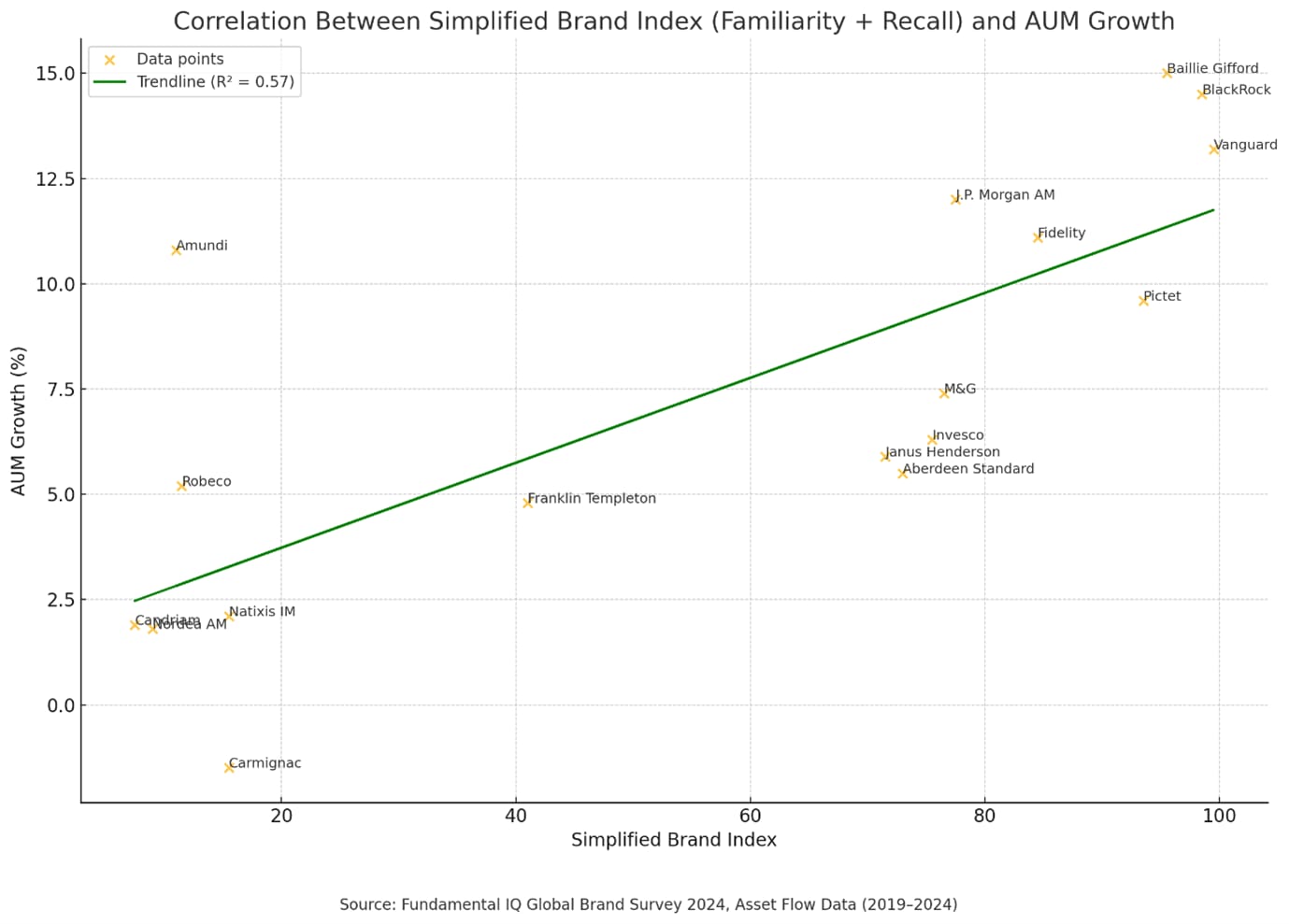

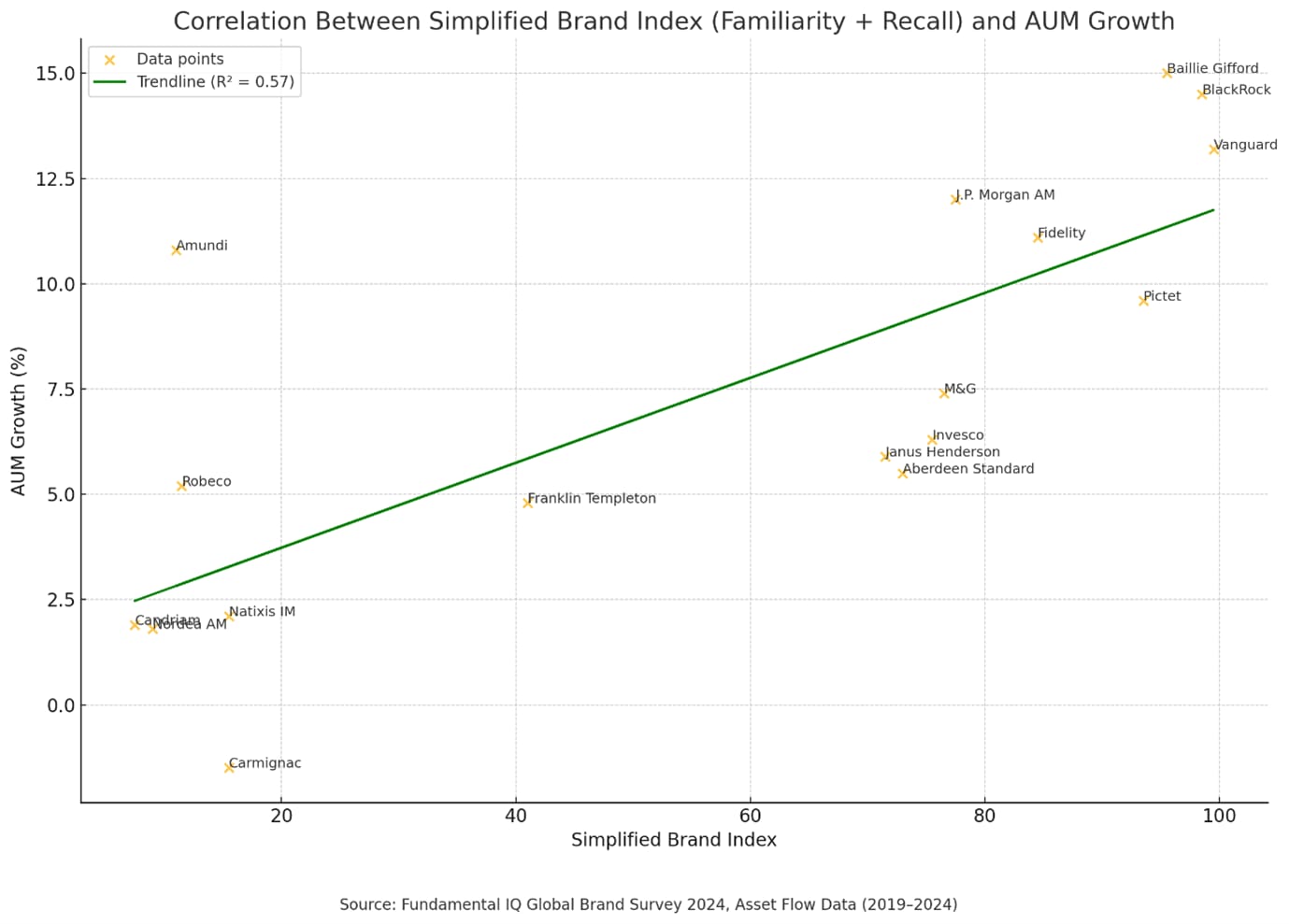

- Fundamental Group’s Global Brand Survey consistently shows that asset managers with higher brand scores gain disproportionately more inflows, regardless of short-term performance.

Conclusion: advertising as a strategic lever

Conclusion: advertising as a strategic lever

Advertising should not be viewed as a consumer-centric indulgence. In professional asset management, it is a strategic lever that supports long-term engagement, sales enablement and client trust. By recognising that professional investors are not immune to human psychology, asset managers can use advertising more effectively to:

- Build lasting brand equity

- Prime the market for sales activity

- Reduce commercial friction

- Support reputation risk management

Far from being irrational, the use of advertising is a rational response to how human decision-making actually works.

Recommendations

- Invest in brand strategy: Not only build familiarity and trust but articulate a differentiated positioning and coherent narrative. Begin with a robust brand audit to assess current perceptions and then define a positioning that reflects your firm's unique strengths, values and purpose. Consistency across all touchpoints – from pitchbooks to social content – is vital. Brand strategy should guide messaging frameworks, visual identity and content tone to ensure clarity and alignment across functions.

- Advertise for mental availability: Ensure your brand is visible and memorable in the right channels. This means maintaining presence across earned, owned and paid media, especially in high-visibility contexts such as the financial press, digital programmatic environments, podcasts and industry events. Prioritise a steady drumbeat of brand exposure to build salience and ensure message consistency regardless of format or platform.

- Lead with emotion, support with logic: Use storytelling and purpose alongside performance messaging. Narratives around stewardship, innovation, heritage and impact help humanise your brand. Emotional storytelling should be complemented with credible facts, awards, client testimonials or research. This dual-layered messaging is more likely to engage both the intuitive and analytical systems of professional investors, as outlined in dual-process theory (Kahneman’s System 1 and System 2 thinking).

- Measure the full funnel: Track both awareness metrics and pipeline conversion rates. Go beyond lead generation to monitor brand lift, recall, favourability and consideration. Leverage attribution models to connect upper-funnel brand advertising to downstream impact e.g. meeting volumes, RFP participation and win rates. Dashboards that integrate CRM data with digital analytics can uncover valuable insights for optimisation. Ensure that your dashboards capture the full data set. SaaS like Alphix Solutions can help you to deliver a full data set on your clients and prospects.

- Align marketing with sales strategy: Use advertising to support sales cycles, not operate in isolation. Marketing efforts should warm up the market, precondition target segments and reinforce key differentiators ahead of and during sales engagements. Equip your relationship managers with campaign context and branded content to ensure message continuity. Foster a culture of feedback between sales and marketing to refine messaging and target more precisely. Too often we see marketing and sales operating in silos rather than collaborating.

Advertising does work, even with professional investors including institutional ones. Those who understand human behaviour already knew that and apply it intelligently in the professional investment landscape.

Similar Articles

The importance of consistent brand advertising in asset management

- Published 05/09/2025

- Education hub

- 12 MIN READ

Do all asset managers need a managed account capability?

- Published 05/07/2025

- Education hub

- 20 MIN READ

How asset managers can show leadership in volatile markets

- Published 05/07/2025

- Education hub

- 14 MIN READ

Conclusion: advertising as a strategic lever

Conclusion: advertising as a strategic lever