Competitor alerts

2 May 2024

Equities and fixed income advertising drops in Europe

However, Europe is the only region where multi asset and ESG promotion is still in vogue, data by Fundamental Monitor finds

Key findings:

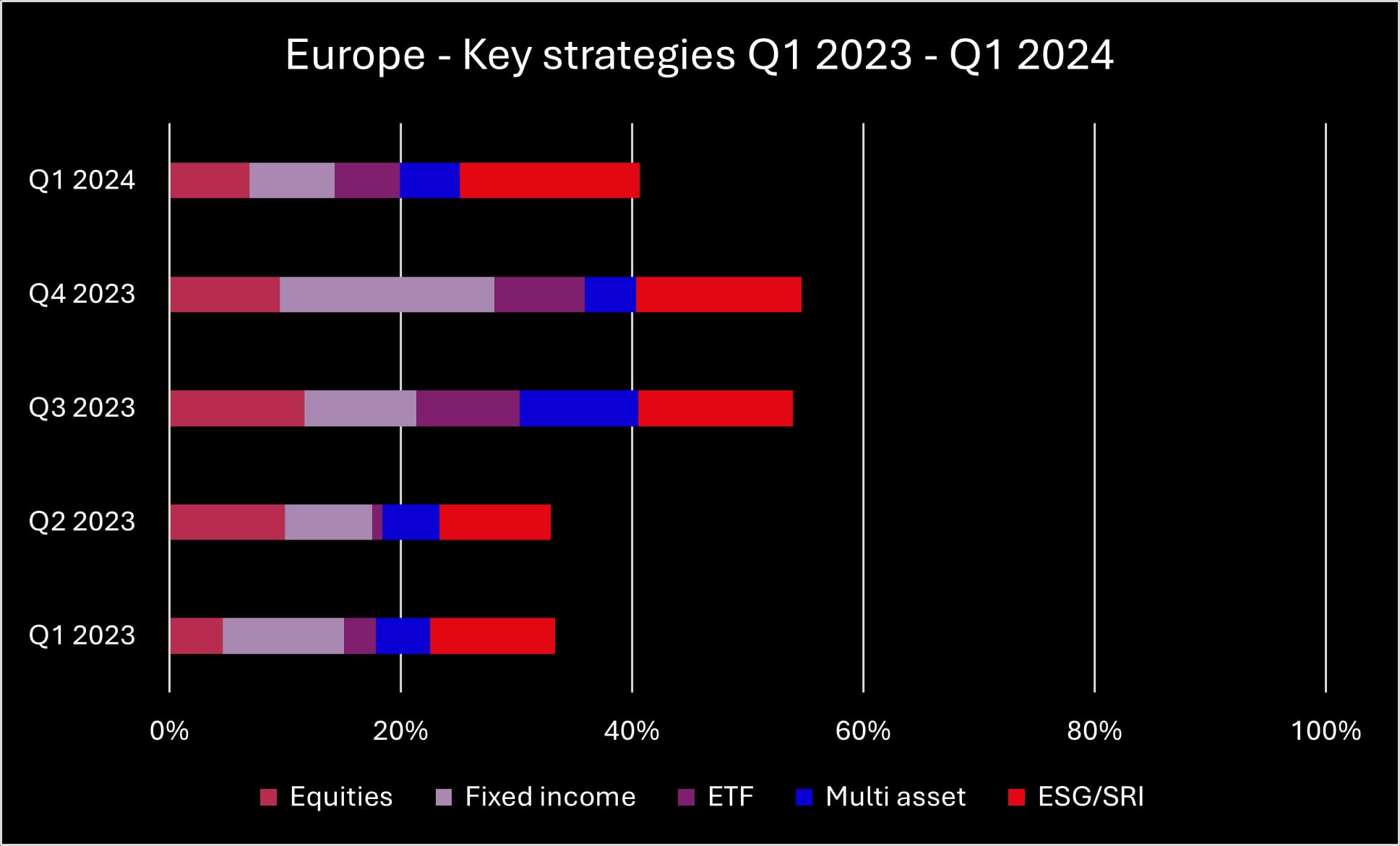

- Asset managers were equally focused on promoting equities and fixed income during Q1 2024, as both stood at 7%, down from Q4.

- Europe is the only region where multi asset and ESG are currently in vogue, standing at 5% of total advertising volume.

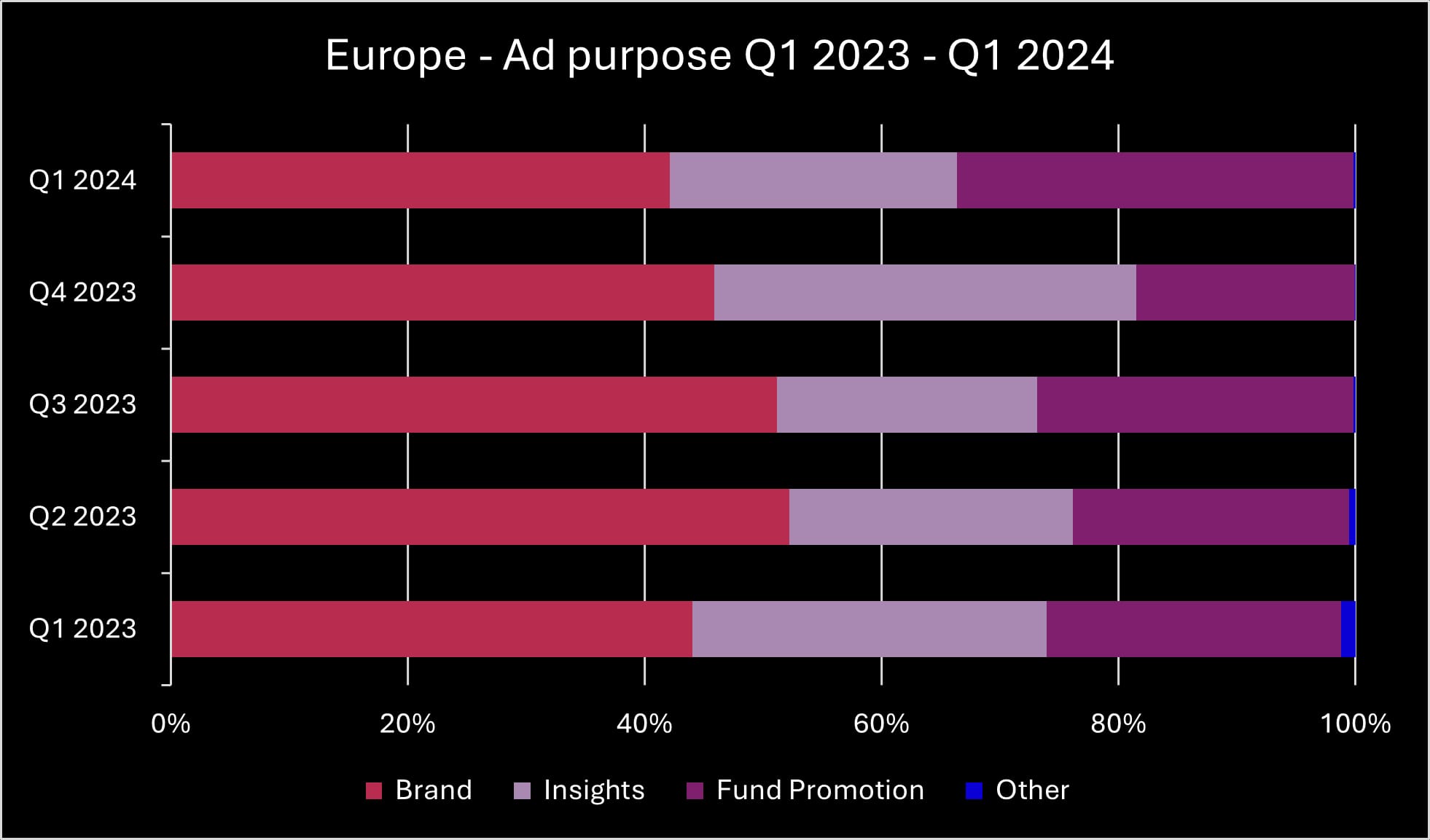

- The percentage of advertising dedicated to fund promotion grew to 33%, while brand campaigns and insights promotion fell.

Asset managers dedicated less of their European advertising to the promotion of equities and fixed income during Q1 2024, data from Fundamental Monitor shows.

Asset managers were equally focused on promoting equities and fixed income, as both stood at 7%. Fixed income advertising has dropped significantly from 19% in Q4 2023, while equities advertising saw a smaller drop from 10%.

Similarly to APAC and North America, the percentage of advertising dedicated to the promotion of ETFs fell and stood at 6% in Q1. However, Europe is the only region where multi asset is currently in vogue, standing at 5% of total advertising volume.

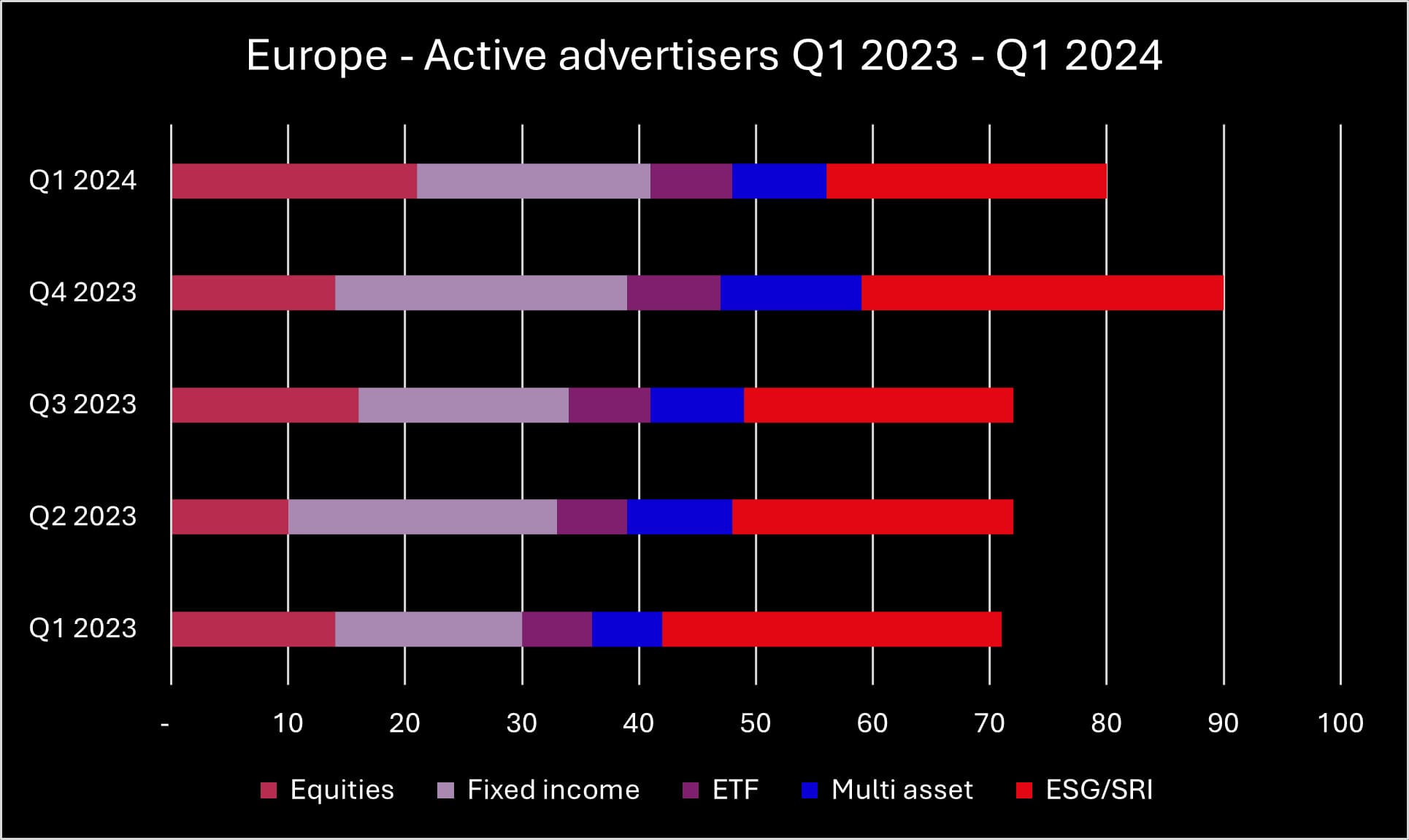

Similarly, ESG remains an important topic in Europe, rising slightly in terms of ad percentage (from 14% to 16%) albeit with a smaller number of active advertisers compared to Q4 (down from 31 to 24 advertisers).

The number of active advertisers for equities and fixed income was also fairly similar in Q1 (21 and 20 respectively), although it had increased for equities and dropped for fixed income compared to the previous quarter.

The percentage of advertising dedicated to fund promotion grew from 18% in Q4 2023 to 33% in Q1 2024. This was to the detriment of both brand campaigns and insights promotion which both fell slightly to 42% and 24%, respectively.

Data from Alphix Solutions, Fundamental Group’s marketing technology business, shows that audience consumption of fixed income content on asset managers’ websites was lower during Q1 compared to the 365-day rolling average.

This indicates that asset managers’ reduced focus on fixed income advertising was mirrored by less interest in these topics among investor audiences. However, content consumption on ESG was down as well, but asset managers had slightly increased their ESG advertising during Q1.

Equities content consumption was up in the first half of January, but then down during the rest of the quarter, by up to 62% in March. Investment audiences were also less interested in ETFs in March, when content consumption dipped significantly, although it was relatively flat during January and February.

Investors consumed less content on multi asset during the first half of January, but consumption improved by up to 30% in the six weeks afterwards to then drop down again for the rest of the quarter by up to 49% compared to the 365-day rolling average.

Below are some of the examples of the type of campaigns that were in market in Europe during Q1 2024:

Brand campaign – Liontrust

Fixed income – Capital Group

Equities – PGIM

Similar Articles

European ESG advertising picks up again after Q3 dip

- Published 03/11/2025

- Competitor alerts

- 3 MIN READ

ESG advertising in APAC recovers slightly but still in single digits

- Published 02/26/2025

- Competitor alerts

- 3 MIN READ

North America sees a record share of ETF advertising

- Published 02/06/2025

- Competitor alerts

- 4 MIN READ