Research insights

23 April 2024

Local managers dominate brand recall rankings among Dutch intermediaries

Regional asset managers were in the top three of recalled companies in all prompted asset classes and management styles, research by Fundamental Media finds

Key findings:

- Six regional managers are in the top 10 of the Brand Equity Index for the Netherlands.

- Unprompted brand recall is a more influential factor when it comes to financial intermediaries’ purchase intentions than familiarity.

- The six most familiar brands are well known among at least 60% of intermediaries.

Financial intermediaries in the Netherlands prefer local managers, with the top ten of the Netherlands Brand Equity Index containing six regional asset managers, research by Fundamental Media found.

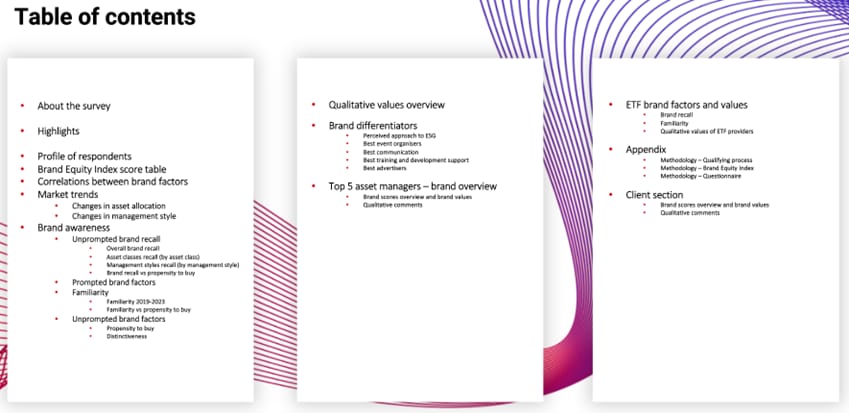

This is one of the key findings from the Netherlands Global Brand Survey 2024, which is based on the responses from 54 financial intermediaries in the Netherlands. To understand their perception of asset managers’ brands, we have developed a Brand Equity Index using a combination of quantitative and qualitative methods across four pillars: recall, familiarity, propensity to buy and distinctiveness.

Financial intermediaries were asked which managers they associate with different asset classes and management styles. Local asset management firms were in the top three of recalled companies in all of these, while global firms were only in the top three of global equities, North American equities, emerging market equities, fixed income, absolute return and smart beta.

Unprompted brand recall is a more influential factor when it comes to financial intermediaries’ purchase intentions than familiarity. On average, half of the respondents are very familiar or quite familiar with 30% of the asset managers prompted. The six most familiar brands are well known among at least 60% of respondents.

Intermediaries were asked to mention up to three asset managers whose funds they are likely to increase the use of over the next 12 months, which was used to calculate each manager’s score for propensity to buy. We also asked respondents what values they attribute to those managers and what makes them want to buy these funds. This revealed that the brands with the highest propensity to buy scores had the most comments on ‘product/know-how’ (62%) and ‘brand’ (27%).

For access to the full report, visit our dedicated Global Brand Survey page.

Similar Articles

US institutional investment landscape dominated by large international players

- Published 01/14/2025

- Research insights

- 3 MIN READ

Print media still popular among German institutional investors

- Published 01/09/2025

- Research insights

- 3 MIN READ

ETFs more popular among US institutional investors than their European peers

- Published 01/06/2025

- Research insights

- 3 MIN READ