Research insights

18 July 2024

Fixed income is the most popular but least competitive asset class in Italy

Research by Fundamental Media also reveals that real estate is the most competitive asset class

Key points:

- Fundamental Media asked financial intermediaries to recall the asset management brands they associate with different asset classes and management styles. This provided insights into the competitiveness of each asset class and management style.

- Real estate and alternatives are the most competitive asset classes, while global equities, North American equities and fixed income are the least competitive. However, fixed income is the asset class that is most likely to see inflows during the next year.

- In terms of management styles, absolute return and smart beta are the most competitive, while ETFs and active management are the least competitive.

Among 15 different asset classes and management styles in Italy, absolute return is the most competitive, while fixed income is the least competitive, research by Fundamental Media shows.

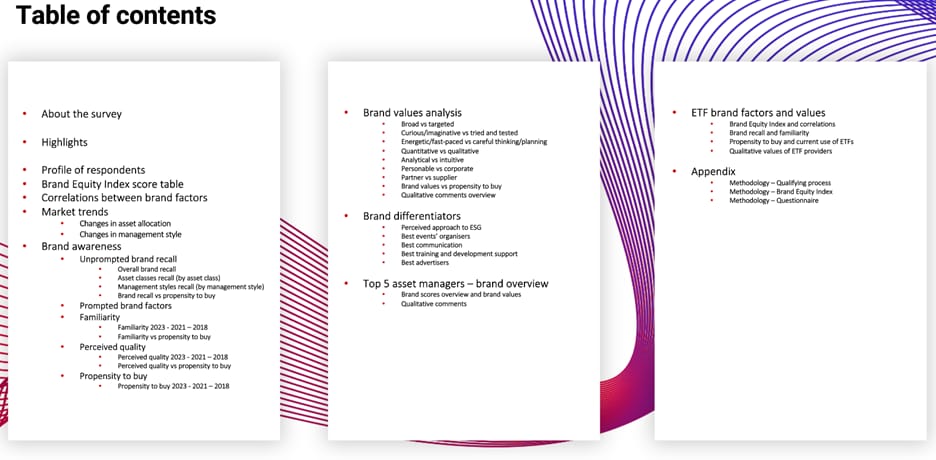

For the 2024 Global Brand Survey, Fundamental Media surveyed 170 financial intermediaries in Italy from June to September 2023 to better understand their perception of asset management brands. The research highlights the strengths and weaknesses of each asset manager’s brand including intermediaries’ ability to recall brands in relation to different asset classes and management styles. The results from this question provide insights into the competitiveness of each asset class and management style.

Italian intermediaries recalled 129 unique asset management brands across the 15 asset classes and management styles prompted. But while many brands were mentioned in all asset classes and management styles, for some the mentions were more evenly spread across many companies while for others a couple of asset managers were recalled a lot more than other managers.

To better understand the competitiveness of each asset class and management style, we looked at the standard deviation in the number of mentions. A low standard deviation in the number of mentions within an asset class or management style indicates that the mentions are more evenly distributed among the different brands within that category. This suggests a more competitive environment because no single brand overwhelmingly dominates the market. Instead, many brands are receiving similar levels of attention, implying that none have a significantly larger market share or recognition than the others.

In contrast, a high standard deviation means that the mentions are more unevenly distributed, with a few brands receiving many more mentions than the others. This indicates less competition, as the market is dominated by a small number of leading brands.

In conclusion, in more competitive asset classes and management styles, companies who put much effort into increasing their visibility might be able to gain market share and move up through the ranking faster compared to less competitive asset classes and management styles, where more effort and time might be needed to reduce the gap with the most established brands.

Respondents recalled the most unique brands in fixed income, multi-asset and European equities, while Italian equities and real estate saw the least number of brands mentioned. But the standard deviation shows that real estate, alternatives and multi-asset are the most competitive asset classes, while global equities, North American equities and fixed income are the least competitive.

The research also found that fixed income is the asset class that is most likely to see inflows during the next year, as 64% of intermediaries plan to increase their clients’ exposure to this asset class, compared to only 8% who are planning a decrease. However, as it’s the least competitive asset class in Italy with only one player that dominates the market, there may be fewer opportunities for other managers to increase their market share. Similarly, global equities is expecting to see a rise in demand (51% plan an increase vs 9% a decrease), but a handful of major global players account for the vast majority of brand recall mentions.

On the other hand, while real estate is the most competitive asset class, it is also the asset class Italian intermediaries are most likely to decrease. This suggests that asset managers specialised in this asset class will need to focus on promoting their ability to provide good returns to remain relevant and gain market share. The majority of respondents (59%) plan a decrease while only 5% plan an increase.

Within the management styles, Italian intermediaries mentioned the most unique asset management brands, while only 20 different ETF brands were recalled. The most competitive management styles are absolute return and smart beta, while ETFs is by far the least competitive, followed by active management.

Active management remains a popular management style, with 55% of respondents planning to increase their exposure to this management style, while 11% of respondents plan to decrease their exposure. For ETFs, 37% of respondents plan an increase and 11% a decrease. There is no significant gap between the percentage of respondents who plan to increase their exposure to absolute return and smart beta and those who expect a decrease.

For access to the full Global Brand Survey report, visit our dedicated Global Brand Survey page.

Similar Articles

US institutional investment landscape dominated by large international players

- Published 01/14/2025

- Research insights

- 3 MIN READ

Print media still popular among German institutional investors

- Published 01/09/2025

- Research insights

- 3 MIN READ

ETFs more popular among US institutional investors than their European peers

- Published 01/06/2025

- Research insights

- 3 MIN READ