Research insights

13 March 2024

Transparency and investment philosophy most important fund selection factors for French intermediaries

Recommendations from peers are the main triggers of research on new funds, Fundamental Media research finds

Key points:

- Transparency and investment philosophy are the two most important factors for French intermediaries when selecting funds.

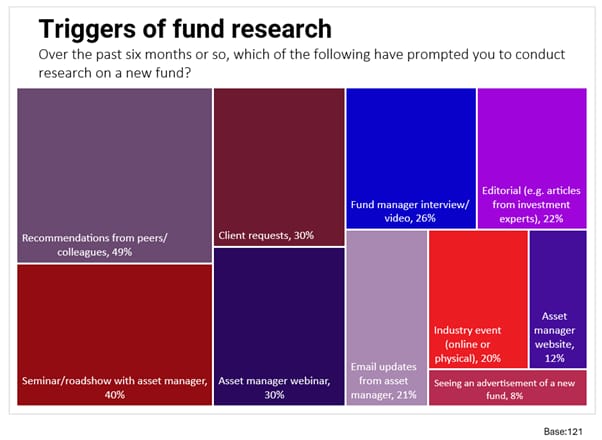

- Recommendations from peers, seminars and client requests are the main triggers of research on new funds.

- The vast majority of French intermediaries (90%) are either very or quite satisfied with the asset managers they work with.

French financial intermediaries consider transparency and investment philosophy to be the most important factors when selecting funds, according to research by Fundamental Media.

However, there are differences between the two audience groups that make up Fundamental Media’s intermediary research. For discretionary portfolio managers and fund selectors (DPM-FS) the most important selection factor is comments/insights from the fund manager, followed by costs and transparency. For financial advisers, the top three consists of transparency, investment philosophy and comments/insights from the fund manager. third most important factor is comments/insights.

From June to September 2023, we surveyed 135 financial intermediaries in France, consisting of 95 financial advisers and 40 discretionary portfolio managers/fund selectors, about their investment views, satisfaction with asset managers and media consumption. The France engagement report is part of our European financial intermediaries research, which also includes reports on the UK, Italy, Germany, Spain, Switzerland and the Netherlands.

For financial intermediaries in France, recommendations from peers, seminars and client requests are the main triggers of research on new funds. Editorial is preferred by advisers, while DPM-FS rely more on industry events and asset managers’ websites. Fund performance and strategy are the most researched information. DMP-FS tend to research more fund information than advisers and seem to look at a higher variety of topics.

The vast majority of French intermediaries (90%) are either very or quite satisfied with the asset managers they work with. Meetings and offline/physical events are the areas of support where satisfaction is the highest. Intermediaries, especially advisers, were the least satisfied with training and development, and insights and thought leadership.

Satisfaction with asset managers’ communication is also high among intermediaries in France, especially regarding regular updates and the quality of content shared. Commentary on asset allocation and regulatory updates are well perceived as well.

Other findings from the 2023 France engagement survey include:

- French intermediaries are the most likely to increase their clients’ exposure to fixed income, emerging market equities, North American equities and European equities.

- The use of print media remained stable compared to 2021. Print publications are now mostly read at the office and less likely to be received at home.

- Over 70% of respondents listen to podcasts for business purposes with DPM-FS more likely to do so.

For access to the full reports, contact [email protected]

Similar Articles

Research reveals competitiveness of asset classes in the Netherlands

- Published 08/20/2024

- Research insights

- 4 MIN READ

ETFs and Swiss equities the least competitive asset classes in Switzerland

- Published 08/16/2024

- Research insights

- 5 MIN READ

German equities least competitive asset class in Germany

- Published 08/12/2024

- Research insights

- 4 MIN READ